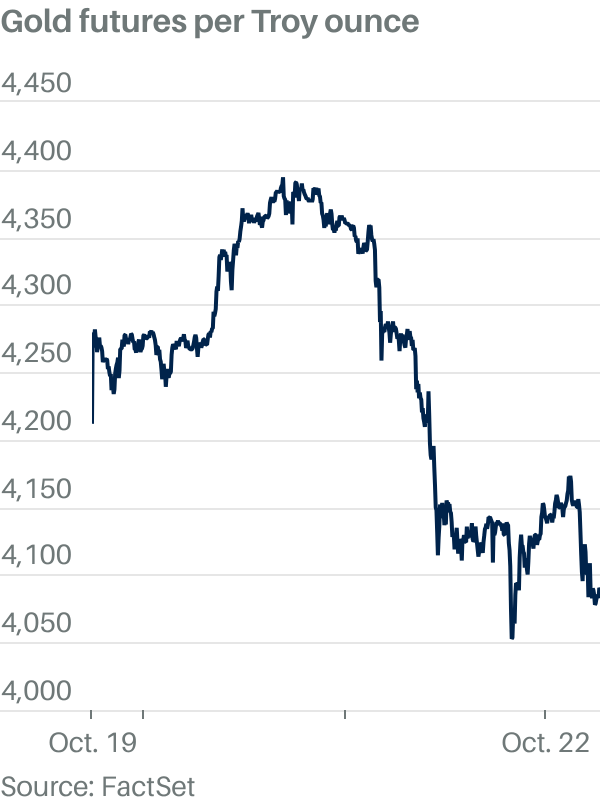

Gold prices were falling again Wednesday, extending bullion’s losses from Tuesday’s brutal selloff.

The most actively traded gold futures contract slid 0.4% to $4,092 an ounce in early trading. Shares in Newmont, one of the world’s largest gold miners, dropped 2.9% ahead of the opening bell, having tumbled 9% the previous session.

The yellow metal plummeted 5.7% on Tuesday, its largest drop in more than 12 years. Investors are locking in profit after a record-breaking run during which gold has performed more like a growth asset than a haven.

View Full Image

“The slump happened despite a decline in nominal and real bond yields, which usually help to support gold prices,” Deutsche Bank macro strategist Henry Allen said. “Given it’s relatively more attractive to hold a zero-interest asset like gold when bonds aren’t yielding as much.”

Allen added: “So in many respects, it looked like a classic pullback after a relentless bull run over recent weeks,” noting that even after Tuesday’s sharp selloff, gold is still on course for its best year since 1979, when the Iranian Revolution sparked an oil crisis and a surge in inflation.

The big question for gold investors is whether this reversal is a sign of what’s to come. While there’s an argument that bullion looks overbought, the same factors that have driven its surge this year—a central-bank buying spree and the prospect of lower interest rates—could provide some support.

Other precious metals also took a hit on Tuesday, but they were having a better time of it on Wednesday. Silver rose 0.5% to $47.92 an ounce and Platinum was up 1.1% to $1,536 an ounce in early trading.

Write to George Glover at george.glover@dowjones.com