One simple press release announcing an OpenAI partnership has been sending shares roaring—and Amazon.com stock is the latest to make it work.

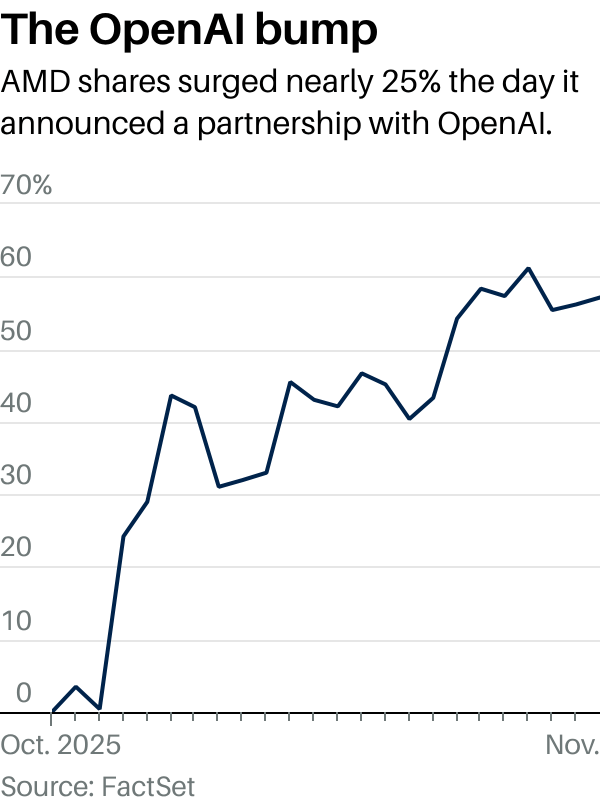

The move has played out repeatedly in markets over the past few months. On Oct. 6, a partnership between OpenAI and AMD sent shares in the chip maker flying higher. One week later, a partnership with OpenAI boosted Broadcom shares. On Oct. 28, PayPal shares jumped double digits before the market open as the company raised its full-year guidance and announced a partnership with OpenAI.

On Monday, Amazon’s announcement of a $38 billion agreement for Amazon Web Services to provide infrastructure for OpenAI’s artificial intelligence workloads sent Amazon stock up about 5% to a new all-time high.

“This market’s…looking at these AI names, and [it’s] saying, are there going to be some new avenues of growth?” says Truist CIO and chief markets strategist Keith Lerner. “By being with one of the market leaders [OpenAI]…market is seeing that as a positive…a little bit of like a halo effect.”

View Full Image

The market reactions are at the core of the fears and promises of the AI trade. Few are arguing that artificial intelligence will flop as a technology. The question is to what extent AI eventually boosts productivity, sends corporate profits higher—and when those gains will actually happen.

For now, market participants are making a clear bet that teaming up with OpenAI—you know, the company that has been driving the AI conversation since the tech-fueled bull market began in the fall of 2022—likely positions that company as an AI winner.

Mizuho Securities senior analyst Dan Dolev tells Barron’s that likely three quarters of PayPal’s initial double-digit post earnings stock move was related to the payment company’s agreement to provide services to OpenAI’s ChatGPT. The other 25%, Dolev says, could likely be attributed to better-than-expected third-quarter results. Dolev adds that if there’s a continued shift to agentic AI commerce, “you want PayPal to be part of it.”

This thinking has been a key part of how many analysts are explaining the stock surges. After AMD shares jumped over 20% on the news of its OpenAI deal, Bank of America senior analyst Vivevk Arya raised his 12-month price target on shares to $250 from a prior target of $200.

“OpenAI is arguably the most disruptive of GenAI cloud computing customers,” Arya wrote on Oct. 6. “And its success is likely to act as a force multiplier for other cloud vendors and LLM providers to accelerate their capex, [and is a ] positive for multiple chip, memory, optical, networking, and foundry suppliers.”

Less than two weeks later, Arya bumped his price target again to $300 citing, among other catalysts, the potential for AMD’s OpenAI deal to drive sales higher than initially anticipated.

In an email to Barron’s UBS analyst Timothy Arcuri, who covers semiconductor stocks such as AMD, says, “I think given the sheer size of some of these deployments, the market is willing to underwrite a lot of incremental earnings from these announced deals.”

Analysts believe these moves are pricing in the potential financial benefit of partnering with OpenAI. But the increasingly entanglement with OpenAI could have reverse impacts too. The theory as it goes right now is that the growth of OpenAI will drive further gains for companies like AMD that are selling chips. It will also benefit payment plays like Shopify and PayPal which are now involved in the OpenAI Instant Checkout feature attached to ChatGPT.

However, should those expectations for OpenAI’s growth fall short, then investors could be caught over their AI hype-cycle skis.

As Truist’s Lerner says, whether real earnings are coming or not, many public companies seeing a boost from partnering with the same private company is still at least enough to “raise an eyebrow.”

“It suggests there’s some enthusiasm and maybe a little bit of froth too, that you just say one name, and we don’t know exactly what the outcome is,” Lerner says. “It’s about potential. And right now, markets are acting positively because of this kind of entrenched AI narrative. And some of the profit side, we’re just not going to really know. Not all these companies are going to benefit the same way.”

But that’s long-term thinking. Right now, there’s nothing like an OpenAI deal to make an investor smile.

Write to Josh Schafer at josh.schafer@barrons.com